Introduction

Most economists, futurists, prognosticators, and armchair quarterbacks agree on one thing when looking at the pandemic’s sustained impact: we’re about to see some deals. Although aggregate deal size is lower than usual, most agree that merger and acquisition (M&A) activity volume is likely to pick up through the end of 2020 (PWC, Crosbie, Financial Post). There are a plethora of triggers leading to this possible outcome right now:

- Government programs that must slow down;

- Deals that went on pause;

- Sustained low levels of economic spending;

- Owner-operator fatigue; and,

- Dry powder ready to be deployed on well-priced acquisitions.

The opportunity to acquire significant growth and scale is here for those with strong balance sheets and capital ready to deploy. There’s also a question of timing if you’re the party looking to buy. Should you wait a little longer for a better price? Do you risk waiting too long and pick up an organization that’s gasping for air? Should you wait for them to fail altogether and pick up the pieces? No one will know the right time to pull the trigger, but you have to be looking at a number of deals to keep yourself from falling in love with any one in particular.

Whether it’s your first deal or you’re a seasoned vet, I’m certain that you’re also considering what you can do to improve M&A outcomes and realize as much of the value outlined in the deal as possible. Leaders have spent years building up their due diligence capabilities to avoid making bad choices or gathering better data to know what they’re inheriting in their acquisitions. Now, leaders need to shift their focus to improving how they lead the integration of their mergers and acquisitions to strengthen overall M&A outcomes.

Whether it’s your first deal or you’re a seasoned vet, I’m certain that you’re also considering what you can do to improve M&A outcomes and realize as much of the value outlined in the deal as possible. Leaders have spent years building up their due diligence capabilities to avoid making bad choices or gathering better data to know what they’re inheriting in their acquisitions. Now, leaders need to shift their focus to improving how they lead the integration of their mergers and acquisitions to strengthen overall M&A outcomes.

Integrating a merger or acquisition is the ultimate leadership challenge. As a leader, do you have the right mindset to lead the integration, or are you holding a dangerous attitude, assumption, or belief that could destroy value after the transaction has closed?

Why should you care?

You’ve heard the stats before. Depending on the author, 50-80% of M&A activity fails to deliver on the value outlined in the deal. Many annihilate value altogether. There’s also more competition looking to deploy capital than ever before, generally acting to push or prop valuations at higher levels. To meet these challenges head-on, most corporate development leaders, origination leaders, and portfolio managers have invested in improving their due diligence capabilities. Despite this increased focus on due diligence, the stats still suggest that your merger or acquisition will not deliver the desired value. Why not?

One answer could be that all of the advancements that have been made in due diligence were never supposed to improve desired outcomes. Hear me out. Most due diligence activities serve to accomplish one of two goals:

- Save investors from making a decision they don’t want to make; or,

- Gathering enough information to understand how to discount or structure the deal.

If you agree with the statements above, it raises the question: how should we measure success from due diligence activities? How do we know the activities we’re spending time on are delivering the value that we need from them?

We believe that we should measure the success of due diligence based on:

- The number of deals we walk away from; and,

- Limiting or reducing the number of preventable surprises that arise post-close.

So what does this all mean? Due diligence has evolved for the better, yet M&A outcomes haven’t demonstrably changed. 50-80% of deals still fail, suggesting that the devil’s in a different set of details. If you’re a business leader looking for better M&A outcomes, it may be time to look beyond improving your due diligence practices. It’s time to improve your approach to post-merger integration as the means to improve your M&A outcomes.

looking for better M&A outcomes, it may be time to look beyond improving your due diligence practices. It’s time to improve your approach to post-merger integration as the means to improve your M&A outcomes.

We recommend starting to assess your integration approach by taking a hard look at yourself as a leader. Are you in the right headspace to lead an integration? Is your team applying the right mindset, or are you holding some dangerous assumptions that could destroy value before you have a chance to capture it?

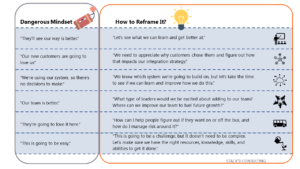

The remainder of this post will outline six dangerous mindsets, perspectives, and assumptions that can destroy value from your transaction post-close. Leaders should be aware of and test themselves against these mindsets during the due diligence phase to set themselves up for a successful integration.

FULL DISCLAIMER. We help companies integrate after the merger or acquisition, so OF COURSE, we believe that the integration is oft-overlooked, under-resourced, and taken for granted. If you want to learn how to run a kick-ass post-merger integration, download a copy of our guidebook here.

6 Dangerous Mindsets in M&A that Destroy Value After Close

| Dangerous Mindset | What Does This Mean? | How to Reframe It? |

| “They’ll see our way is better.”

|

What an arrogant thought to have, even if it ends up being true. Why purchase a company if there are no redeeming qualities within it? You should always take time to learn what made your acquisition special and why they won with their customers and with their employees – even if it is for no reason other than to be aware of what you’re putting at risk by ignoring it. | “Let’s see what we can learn and get better at.” |

| “Our new customers are going to love us” | If one of the values of the deal was buying the book of the business, this one is critical. Why did customers choose this provider? Truly, why did they? Fail to learn and you risk destroying those relationships and losing their business. Understanding their customer promise is more than locking in key personnel into a buy-out schedule, regardless of what karat your golden handcuffs are. | “We need to appreciate why customers chose them and figure out how that impacts our integration strategy.”

|

| “We’re using our system, so there’s no decisions to make.” | Let’s get one thing clear. It’s totally acceptable to know which system you’re going to move forward with at or before close. Hell, it might even be in the deal rationale. That shouldn’t give you a free pass not to learn, understand and appreciate why and how the business made the decisions it made. The outcome can be efficiencies or improvement opportunities to your own systems and a resulting synergy being a ‘double-dip’ of value delivered. | “We know which system we’re going to build on, but let’s take the time to see if we can learn and improve how we do this.” |

| “Our team is better.” | You don’t know what you’re saying no to. While we may want to stay with the partner we brought to the dance, anything short of a meritocracy is going to scream of nepotism and start to poison the well at a time when your leadership actions are landing on a highly impressionable workforce. Avoiding hard conversations early leads to mediocrity at best and unwanted turnover at worst. | “What type of leaders would we be excited about adding to our team? Where can we improve our team to fuel future growth?”

|

| “They’re going to love it here.” | You may be the inspirational leader that your employees love today. They also picked to work for you and continue to choose to stay. These new faces don’t know you, didn’t pick you as their leader, and certainly don’t owe you anything. You need to earn it. Until you’ve personally built trust, know that you’re making withdrawals against it every day. This counts for extra points if you’re attempting an acquihire. | “How can I help people figure out if they want on or off the bus, and how do I manage risk around it?”

|

| “This is going to be easy.” | Maybe it will be. However, assuming it will be is foolhardy, arrogant, and irresponsible. When you buy a house, the first thing you get is insurance. You protect the investment. Post-Merger Integration is an exceptional leadership challenge. Not a project management activity. Are you ready? | “This is going to be a challenge, but it doesn’t need to be complex. Let’s make sure we have the right resources, knowledge, skills, and abilities to get it done.” |

Can you see the theme above? Not enough leaders are ready to learn from their acquired entities. As a leader, you can avoid these dangerous mindsets by humbling yourself, parking your ego, and approaching every interaction as an opportunity to learn, improve, and grow as a company.

Closing

Don’t fall into the trap of the deal high, and park your instincts to hide your weaknesses and only project strength. Go into discussions looking to learn, and you’ll see that your merger or acquisition is well on the path to beat the odds and deliver all the value you desire.

Call-to-Action

Are you worried that you or members of your team are at risk of holding these dangerous mindsets? Forward this blog on to them and book a meeting to discuss how your integration approach should evolve to shine a light on these mindsets and reframe them to learning and growth challenges in integration!